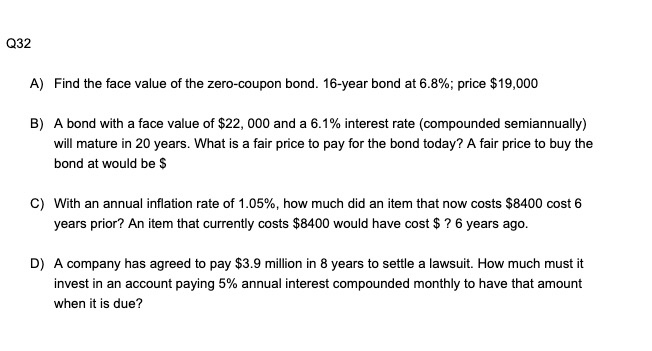

40 find the face value of the zero coupon bond

› bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow 19.04.2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. This calculation is I, the periodic interest paid. For example, if the bond pays interest semiannually, I = $30 per period. Each period is 6 months. Determine discount rate. Divide the …

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

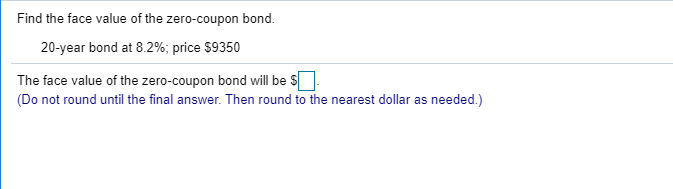

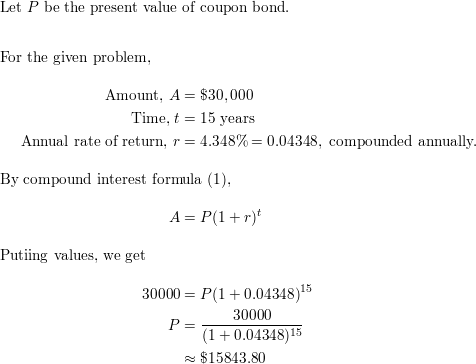

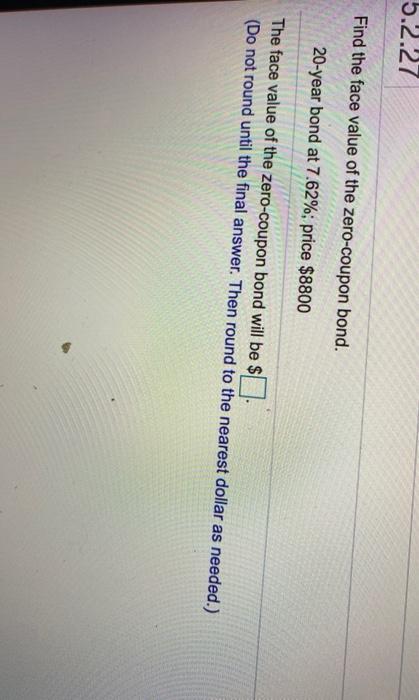

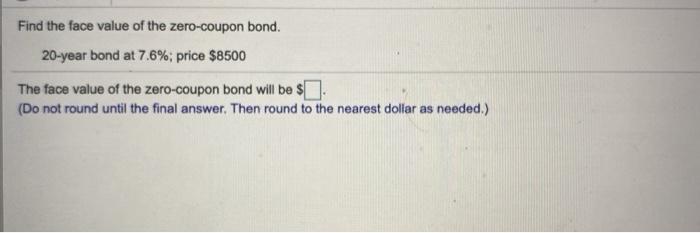

Find the face value of the zero coupon bond

Zero-Coupon Bonds: Characteristics and Examples - Wall Street … Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value. › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Find the face value of the zero coupon bond. Home | NextAdvisor with TIME With 2 Days to Lock in a 9.62% I Bond Rate, We Answer Your Questions 7 min read. You Can Now Earn 2.35% with a Capital One Savings Account. How to Maximize Higher Interest Rates 3 min read . Jumbo ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping 16.07.2019 · n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond. Assuming the bond discount rate remains the same (7%), then the price … en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a set amount of money, but most zero coupon bonds pay a set amount of money known as the face value of the bond. Zero coupon bonds may be long or short-term investments. › the-basics-of-bondsThe Basics of Bonds - Investopedia Jul 31, 2022 · Bonds are generally priced at a face value (also called par) of $1,000 per bond, but once the bond hits the open market, the asking price can be priced lower than the face value, called a discount ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Sep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. Bond Valuation: Calculation, Definition, Formula, and Example 31.05.2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Zero Coupon Bond Value - Formula (with Calculator) - finance … To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, …

How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · With no coupon payments on zero-coupon bonds, their value is entirely based on the current price compared to face value. As such, when interest rates are falling, prices are positioned to rise ... › terms › bBond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... What Is the Face Value of a Bond? - SmartAsset 21.09.2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Zero-Coupon Bonds: Characteristics and Examples - Wall Street … Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 find the face value of the zero coupon bond"