38 coupon interest rate definition

BASIC FACTS ABOUT CAPITAL MARKETS - Securities & Exchange Commission ... The "T+3"trading system is the three day process required for a transaction involving shares to settle on the stock exchange. Literally translated, it stands for "Transaction + 3 business days". In the case of debts securities, "T+0"is the trading system. In other words, the transaction settles on the same day as it takes place. en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

What Is Fixed Income Investing? - The Balance Fixed income investing focuses on investments that pay a return on a fixed schedule. These returns could be dividends or coupon payments. Those who are looking to adopt this method often focus on low-risk investments. These may be bonds , bond mutual funds, money market funds, certificates of deposit (CDs), and blue chip stocks .

Coupon interest rate definition

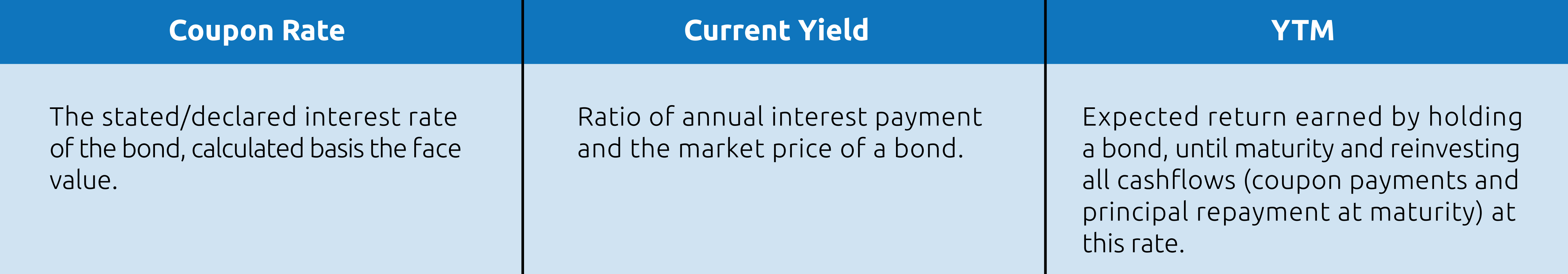

What Is the Prime Rate? How It's Set and How It Affects You The prime rate is the interest rate that banks charge their most creditworthy clients, usually banks or extremely wealthy individuals. Though not set by the government, the prime rate runs about 3 ... Accounts That Earn Compounding Interest | The Motley Fool Compound interest is used in investment and savings contexts. The simple interest formula is A = P (1 + RT). You can find the variables defined in the next section. This means the account value is... How to calculate the effective interest rate — AccountingTools The effective interest rate is the usage rate that a borrower actually pays on a loan. It can also be considered the market rate of interest or the yield to maturity. This rate may vary from the rate stated on the loan document, based on an analysis of several factors; a higher effective rate might lead a borrower to go to a different lender.

Coupon interest rate definition. Protect Your Purchasing Power From Inflation - NerdWallet Online banks and credit unions often offer high-yield savings accounts that sweeten returns, especially as interest rates rise. Perhaps the most powerful idea of all: Ask for a raise . 30-Day Average SOFR (SOFR30DAYAVG) | FRED | St. Louis Fed Units: Percent, Not Seasonally Adjusted Frequency: Daily Notes: As an extension of the Secured Overnight Financing Rate (SOFR), the 30-day SOFR Average is the compounded average of the SOFR over a rolling 30-day period. For more information on the production of the SOFR Averages and Index—including the calculation methodology, treatment of non-business days, and value dates—please read the ... Call Provision - Meaning, Types, Working and More It is a provision in a bond's indenture that enables the issuer to call or redeem the full or part of the issue before the maturity date. It is only an option for the issuer, not an obligation. One may also call it a redemption provision or a provision that makes the bond callable. Usually, the indenture may include one or more call dates. Interest rate hike benefits still elude term depositors The average deposit rate of two-year bank deposits is at 5.59 percent versus 6.48 percent yield in the two-year government, making a differential of 89 basis points, the highest since April, 2018. "The country's overall long-term investment by households in the banking system may come down with people already facing the brunt of elevated ...

Prime Rate Definition - Investopedia Interest rates provide a way to cover costs associated with lending and they act as compensation for the risk assumed by the lender based on the borrower's credit history and other financial... 5-Year, 5-Year Forward Inflation Expectation Rate (T5YIFR) | FRED | St ... Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department. Suggested Citation: Federal Reserve Bank of St. Louis, 5-Year, 5-Year Forward Inflation Expectation Rate [T5YIFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https ... australiancoupons4u Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. › interest-rate-swapsInterest Rate Swaps Explained – Definition & Example Sep 14, 2021 · Interest rate swaps are traded over the counter, and if your company decides to exchange interest rates, you and the other party will need to agree on two main issues: Length of the swap . Establish a start date and a maturity date for the swap, and know that both parties will be bound to all of the terms of the agreement until the contract ...

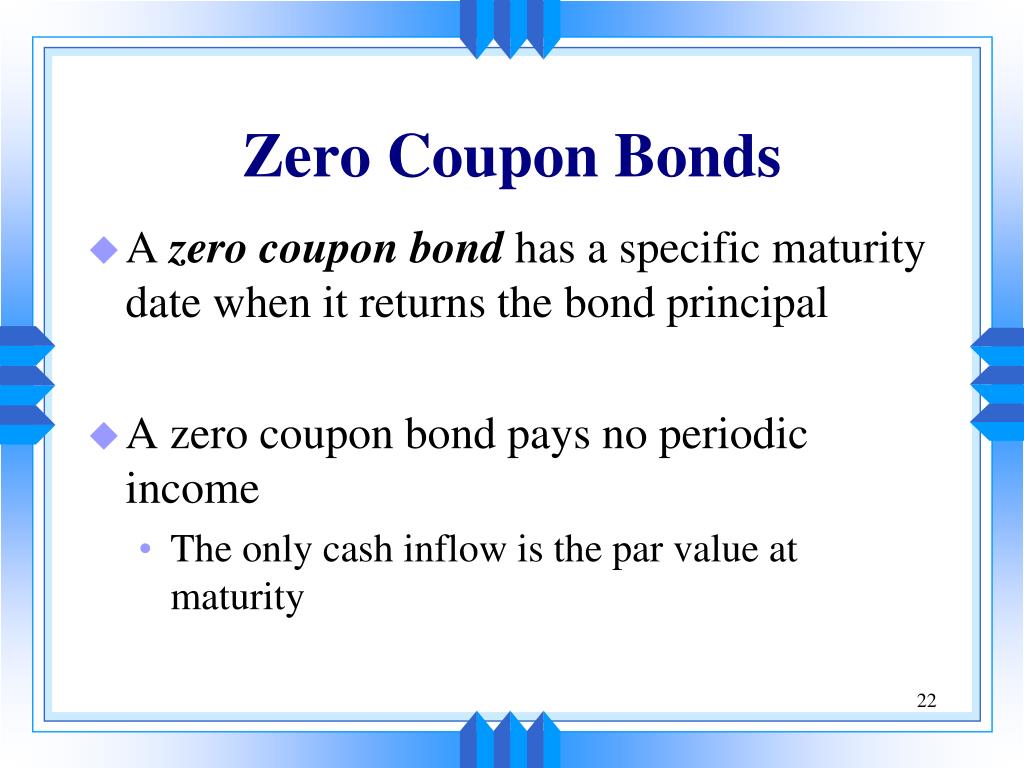

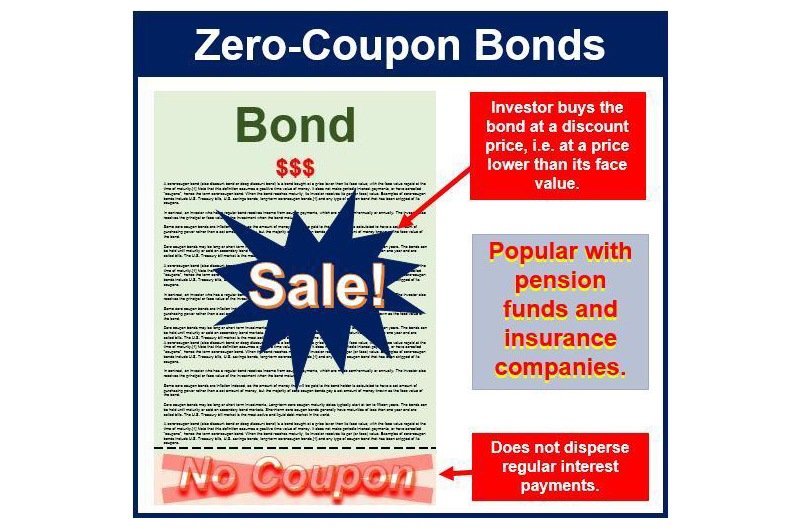

› terms › iInterest Rate Floor Definition - Investopedia May 20, 2022 · Interest Rate Floor: An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product. Interest rate floors are utilized in derivative ... Three-Month SOFR Overview - CME Group Boasting a user base of 1,300+ global participants and volumes exceeding $1.5 trillion notional per day, Three-Month SOFR futures (SR3) offer the deepest centralized pool of liquidity, price discovery, and risk management on the Secured Overnight Financing Rate (SOFR), the USD risk-free reference rate which tracks the cost of borrowing cash ... The Fed - H.15 - Selected Interest Rates (Daily) - June 13, 2022 3. Annualized using a 360-day year or bank interest. 4. On a discount basis. 5. Interest rates interpolated from data on certain commercial paper trades settled by The Depository Trust Company. The trades represent sales of commercial paper by dealers or direct issuers to investors (that is, the offer side). Bullhead Citys Coupon What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do.

› discount-rate-vs-interest-rateDiscount Rate vs Interest Rate | 7 Best Difference (with ... Interest Rate: Discount Rate : Meaning: An interest rate is an amount charged by a lender to a borrower for the use of assets. Discount Rate is the interest rate that the Federal Reserve Banks charges to the depository institutions and to commercial banks on its overnight loans. Charged on: Individuals/ Borrowers: Depository institutions ...

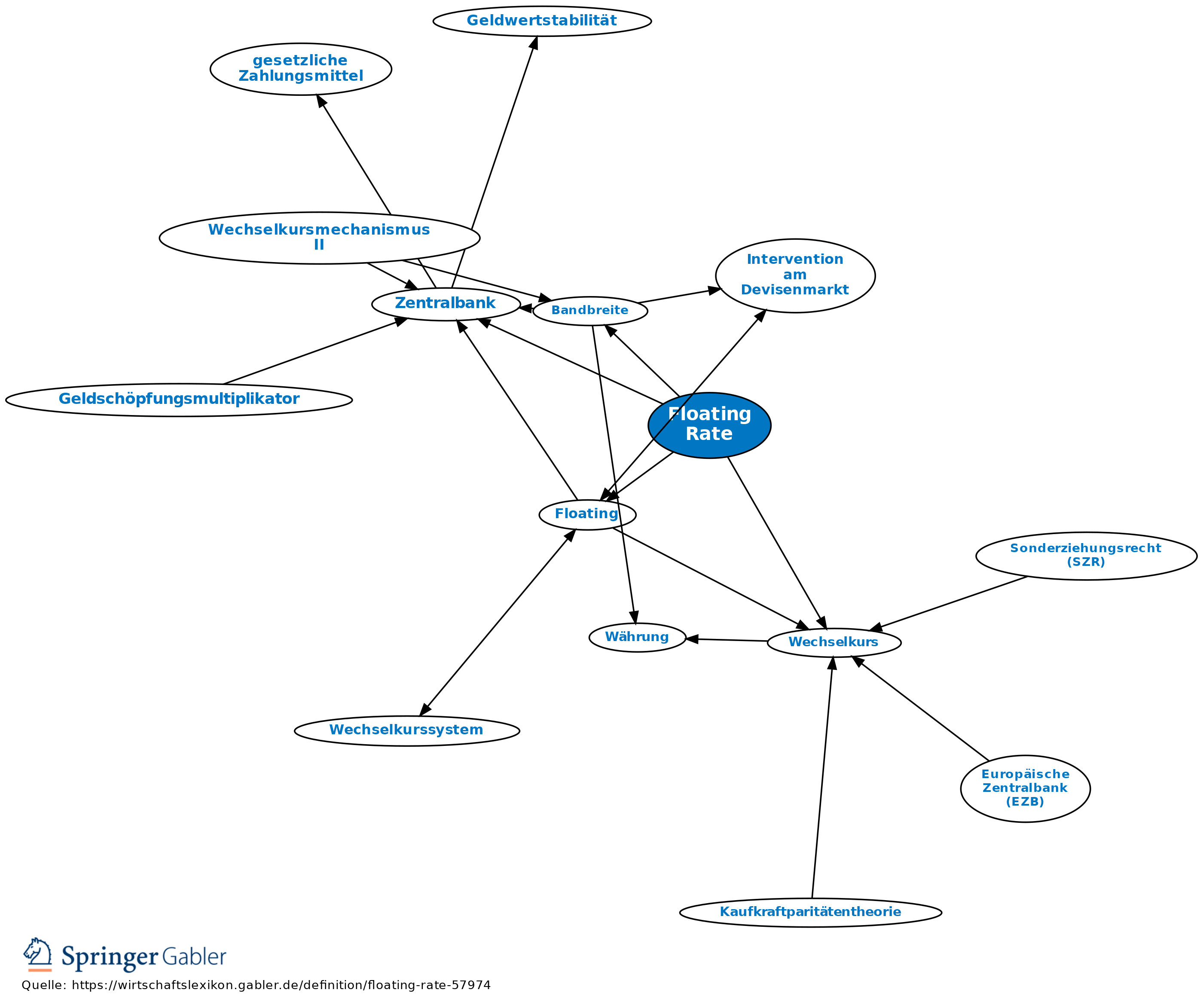

Floating Rate Bonds | Meaning, Funds, ETF, Duration, Maturity - eFM a floating rate of interest means a rate of interest derived using a benchmark or reference rate, which could be any external interest rate like u.s. treasury bill rates, libor, euribor, federal funds rate, etc. normally, a margin or spread is added to the reference rate, and the coupon rate is denoted as 'libor + 1% ', ' euribor + 1% ', or ' …

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Overnight Rate Definition - Investopedia The overnight rate is the interest rate at which a depository institution (generally banks) lends or borrows funds from another depository institution in the overnight market. In many countries,...

APR Vs. Interest Rate: What's The Difference? - Rocket Mortgage What Is Interest Rate? Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, which means it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, which means it might change depending on market rates.

2022 Ford® Explorer SUV | Pricing & Incentives 176. You may qualify for as much as $7,500 in federal tax incentives for purchasing an all-electric Ford vehicle. The federal tax credit is a potential future tax savings. The amount of your tax savings will depend on your individual tax circumstances.

› terms › iInterest Rate Swap Definition - Investopedia Aug 31, 2021 · Interest Rate Swap: An interest rate swap is an agreement between two counterparties in which one stream of future interest payments is exchanged for another based on a specified principal amount ...

Mortgage Rates Today, June 11, & Rate Forecast For Next Week What's moving current mortgage rates. According to Mortgage News Daily's (MND's) data, the average rate for a 30-year, fixed-rate mortgage soared by 30 basis points yesterday (a basis point ...

Netherlands Government Bonds - Yields Curve The Netherlands 10Y Government Bond has a 1.830% yield.. 10 Years vs 2 Years bond spread is 82.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016).. The Netherlands credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.70 and implied probability of default is 0.18%.

The Fed - Commercial Paper Rates and Outstanding Summary Data as of May 26, 2022 Posted May 27, 2022. Daily rates for commercial paper are provided for the AA nonfinancial, A2/P2 nonfinancial, AA financial, and AA asset-backed categories. The criteria that determine which issues are included in the rate categories are detailed in the Rate Calculations section of the About page of this release.

Coinbase Offered Them Dream Jobs—and Then Took Them Away Coinbase's remote work policy also afforded him the ability to move wherever he wanted, and he quickly signed a lease for an apartment in Dayton, Ohio, to be closer to his girlfriend. When the ...

Fed attacks inflation with its largest rate hike since 1994 With the additional rate hikes they foresee, the policymakers expect their key rate to reach a range of 3.25% to 3.5% by year's end — the highest level since 2008 — meaning that most forms of...

Simple vs. Compound Interest | The Motley Fool If you borrow $1,000 and pay a simple interest rate of 7% for five years, then you would pay a total of $350 in simple interest on the debt. ... If you invest $10,000 in a bond that pays a 5% ...

Bangladesh Government Bonds - Yields Curve Last Update: 12 Jun 2022 8:15 GMT+0. The Bangladesh 10Y Government Bond has a 8.110% yield. 10 Years vs 2 Years bond spread is 82 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in September 2020). The Bangladesh credit rating is BB-, according to Standard & Poor's agency.

en.wikipedia.org › wiki › InterestInterest - Wikipedia In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate.

Post a Comment for "38 coupon interest rate definition"