39 us treasury coupon rate

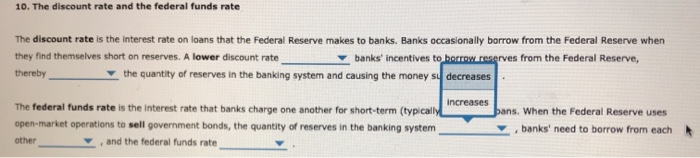

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

Us treasury coupon rate

Individual - TIPS: Rates & Terms - TreasuryDirect Follow the link and locate the Index Ratio that corresponds to the interest payment date for your security. Multiply your original principal amount by the Index Ratio. This is your inflation-adjusted principal. Multiply your inflation-adjusted principal by half the stated coupon rate on your security (i.e., 2%). Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ... Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

Us treasury coupon rate. Check out 30 year US treasury last price's stock ... - CNBC Yield Open 2.966% Yield Day High 3.006% Yield Day Low 2.904% Yield Prev Close 2.929% Price 85.3594 Price Change -1.2031 Price Change % -1.3906% Price Prev Close 86.5625 Price Day High 87.0156 Price... Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 2008-2012 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2003-2007 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2008-2012 20 Year Treasury Rate - YCharts Apr 29, 2022 · The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.21%, compared to 3.21% the previous market day and 2.16% last year. US Treasury Zero-Coupon Yield Curve - data.nasdaq.com US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed a day ago, on 6 May 2022 Frequency daily Description These yield curves are...

How does the U.S. Treasury decide what coupon rate to ... Answer (1 of 3): The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge pr... How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments remain... Treasury I-Bonds are Paying 7.12%! — Sapient Investments Treasury I-Bonds are paying 7.12%! You can only buy up to $10,000 worth each year ($20,000 for a couple), so act now to fill your 2021 order, and then in January buy another $10,000 each. It's a slam-dunk fixed income winner. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

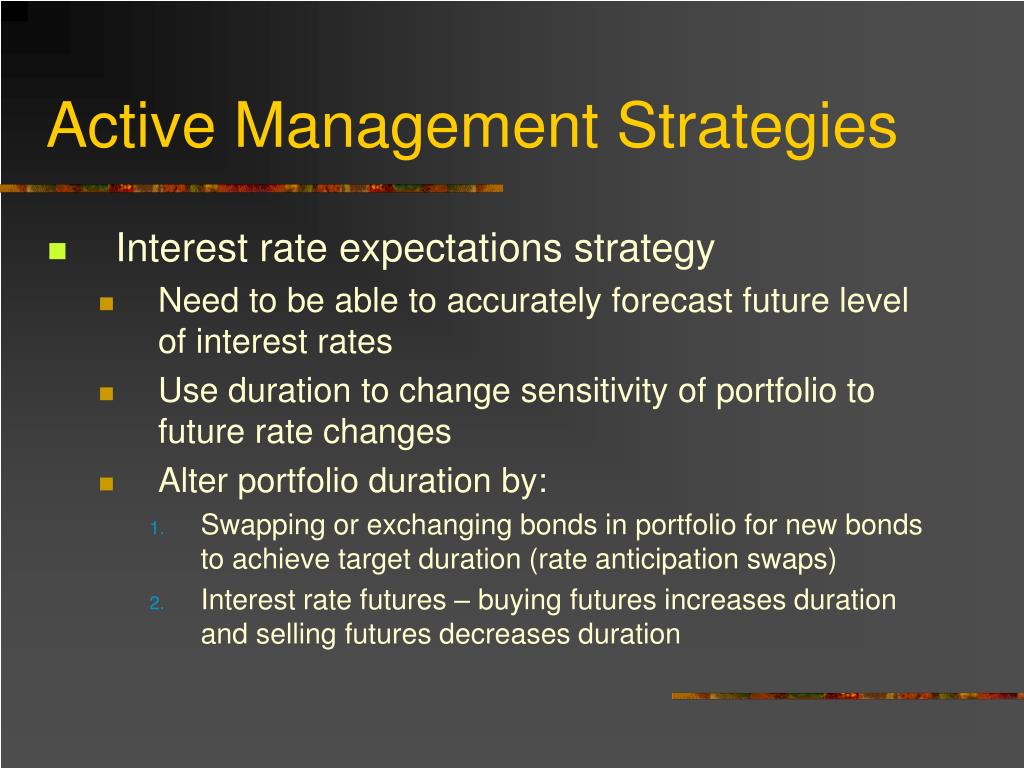

Treasury Coupon Issues and Corporate Bond Yield Curves | U ... Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. 10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest... Individual - Floating Rate Notes (FRNs): Rates & Terms The interest rate is the sum of two components: an index rate and a spread. Index rate. This rate is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week bill every week, so the index rate of an FRN is re-set every week. Spread. The spread is a rate we apply to the index rate.

Interest Rates - United States Secretary of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated.

5 Year Treasury Rate - YCharts Apr 29, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 2.93%, compared to 3.01% the previous market day and 0.82% last year.

10-Year US Treasury Note - Guide, Examples, Importance of 10 ... The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond.

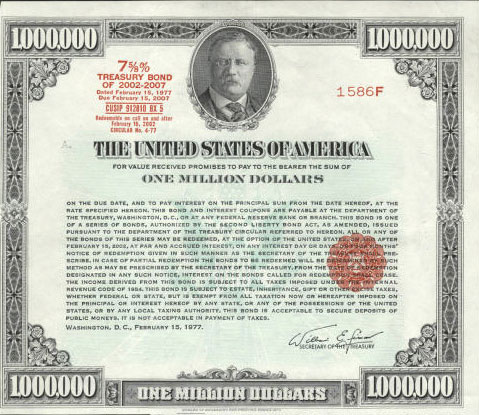

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

Financial strategist says 'The Great Crash of 2018' will start in bond market -- Society's Child ...

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.940% yield.. 10 Years vs 2 Years bond spread is 20 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in March 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 15.20 and implied probability of default is ...

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent...

US5Y: U.S. 5 Year Treasury - Stock Price, Quote and ... - CNBC Latest On U.S. 5 Year Treasury. 10-year yield touches 3.14% for the first time since 2018 May 6, 2022CNBC.com. 10-year Treasury yield surges as high as 3.1%, hitting highest level since 2018 May 5 ...

Resource Center | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. ... Daily Treasury Long-Term Rates. ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues.

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

United States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... US 10-year T-Note Auction Coupon Rate; US Treasury ETFs; US Bond Yield Spread; Copper / Gold vs. 10-year US T-Note Yield; US Bond Yield vs. Real Interest Rate; US Treasury Gross Issuance; US 10-year T-Note Bid-to-cover Ratio; US 10-year T-Note Yield vs. TIP/TLT; US Treasury General Account Balance; US ACM 10Y Treasury Term Premium

US20Y: U.S. 20 Year Treasury - Stock Price, Quote ... - CNBC Yield Open 3.091% Yield Day High 3.214% Yield Day Low 3.09% Yield Prev Close 3.126% Price 87.9062 Price Change -1.0625 Price Change % -1.1953% Price Prev Close 88.9688 Price Day High 89.4688 Price...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ...

Post a Comment for "39 us treasury coupon rate"